Introduction to MT103 Document

In today’s global economy, sending and receiving money across borders is a daily necessity for individuals, businesses, and financial institutions. With trillions of dollars transferred internationally every year, banks rely on the SWIFT network to ensure security, accuracy, and compliance. Among the different message types in SWIFT, the MT103 Document plays a critical role in international payments.

The MT103 Document is often treated as the “official receipt” of a cross‑border bank transfer—except it comes from the standardized SWIFT messaging system. Below, we’ll explain what it is, how it works, what’s inside it, and how you can request and read one.

Understanding the Basics of SWIFT and International Payments

What is the SWIFT Network?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging system that connects thousands of banks and financial institutions. SWIFT doesn’t move money; it securely transmits payment instructions between institutions so funds can be settled by the banks involved.

Role of MT Messages in Cross‑Border Transfers

SWIFT messages are grouped into MT (Message Types), each serving a different purpose. For example:

- MT103: Single customer credit transfer (customer‑to‑customer).

- MT202: Bank‑to‑bank transfer and cover payments.

- MT940: Statement message (account reporting).

Among these, MT103 is the most recognized by customers because it’s issued for cross‑border payments between individuals or companies.

MT103 Document Explained

Definition of MT103

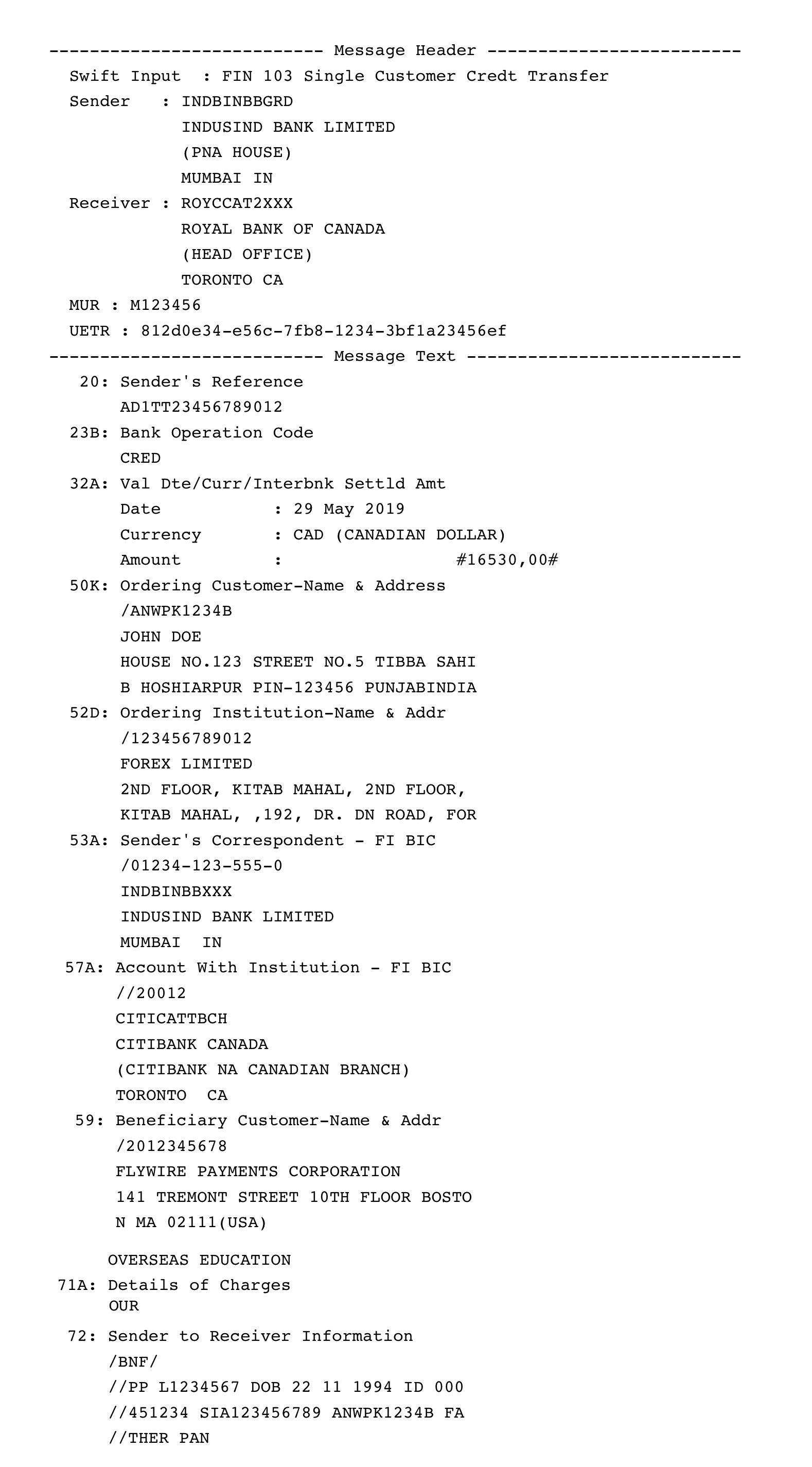

An MT103 Document is a standardized SWIFT message confirming that a single international credit transfer has been initiated. It contains the key details of the payment—sender, receiver, amount, currency, dates, and references—so banks and customers can track and verify the transaction.

Key Purpose of MT103 Document

- Provides proof of payment instruction for international transfers.

- Enables both banks and customers to trace a transfer end‑to‑end.

- Supports regulatory compliance and audit trails (e.g., AML requirements).

Structure and Format of MT103 Document

Essential Fields in MT103

While layouts may vary by bank system, a typical MT103 includes:

- Transaction Reference Number (

:20:) - Value Date, Currency, Amount (

:32A:) - Ordering Customer (

:50K:or:50A:/:50F:) - Beneficiary Customer (

:59:or:59A:) - Intermediary/Receiving Bank BICs

- Details of Charges (

:71A:— OUR/SHA/BEN) - Remittance Information (

:70:)

Example of a MT103 Document

:20: TXREF123456789

:32A: 250824 USD 50000,

:50K: JOHN DOE, 123 MAIN ST, NEW YORK US

:59: ACME GMBH, BERLIN DE

:70: INVOICE 2025-081

:71A: SHA

Why MT103 is Important in International Banking

Proof of Payment

For many counterparties, the MT103 serves as a strong confirmation that funds are on their way, allowing shipment or service delivery to proceed while the payment settles.

Compliance and Security Role

MT103 data supports compliance checks and helps institutions satisfy AML and audit requirements by documenting the parties, purpose, and routing.

Tracking International Transfers

If a transfer is delayed or appears missing, the MT103’s references and routing enable banks to trace the payment path and locate the hold‑up.

Difference Between MT103 and Other SWIFT Messages

MT103 vs MT202

- MT103: Customer‑to‑customer credit transfers with full payment details.

- MT202: Bank‑to‑bank transfers and cover settlements.

In short, MT103 is customer‑facing; MT202 is bank‑facing.

MT103 vs Payment Confirmation

A bank receipt confirms your instruction, but an MT103 is a standardized SWIFT message with deeper data, making it more useful for tracing and counterpart verification.

Who Issues a MT103 Document?

A valid MT103 can only be issued by a SWIFT‑connected sending bank (or a regulated provider operating via a sponsoring bank). Intermediaries cannot create a legitimate MT103 independently.

How to Request and Obtain a MT103 Document

From Your Bank

- Request the MT103 once your international transfer is initiated.

- Some banks provide it automatically; others require a request or small fee.

From Payment Providers

If you used a money transfer provider, you can typically download the MT103 (or equivalent SWIFT copy) from your dashboard or ask support. See helpful references from Wise, Flywire, and Money Mover.

Limitations and Misconceptions About MT103

Not a Proof of Funds

An MT103 shows that a payment was sent, not that funds have cleared into the beneficiary’s account. It’s evidence of instruction, not final settlement.

Timeframe of Availability

Depending on bank processes and compliance checks, obtaining a copy can take 1–3 working days.

Use Cases of MT103 Document

Businesses and Corporations

- Reassure suppliers that funds are en route.

- Maintain documentation for audits and trade finance.

Individuals Sending Money Abroad

- High‑value payments (tuition, property, medical bills).

- Peace of mind for family support or relocations.

How to Read and Understand an MT103 Document

Breaking Down Each Field

| Field Code | Meaning |

|---|---|

:20: | Transaction Reference Number |

:32A: | Value Date, Currency, Amount |

:50K: | Ordering Customer |

:59: | Beneficiary Customer |

:70: | Remittance Information |

:71A: | Details of Charges (OUR/SHA/BEN) |

Common Terminology Used

- BIC/SWIFT Code: unique identifier for banks.

- Intermediary Bank: additional bank that routes the payment.

- Charges (OUR/SHA/BEN): who pays fees—sender, shared, or beneficiary.

Security Considerations in MT103

Avoiding Fraud and Misuse

Only accept MT103 copies issued by your bank or regulated provider. Be cautious of altered PDFs or suspicious “screenshots.”

Data Privacy in International Transfers

MT103s contain sensitive personal and banking data. Store them securely and share them only with trusted counterparties.

Real‑World Example of MT103 in Action

A U.S. company wires USD 50,000 to a German supplier. After initiating the transfer, the bank provides the MT103. The supplier uses it as evidence the funds are on the way, prepares shipment, and both banks can trace the transaction using the MT103 references if needed.

Frequently Asked Questions (FAQs)

1) What is the difference between MT103 and MT202?

MT103 covers single customer credit transfers; MT202 is bank‑to‑bank settlement/cover. They serve different parties and purposes.

2) Can I use MT103 as proof of funds?

No. It confirms the payment was initiated but doesn’t prove the beneficiary has received the funds.

3) How long does it take to receive a MT103?

Usually 1–3 working days after initiating the transfer, subject to bank processes.

4) Can individuals request MT103 from their bank?

Yes. Most institutions can provide a copy upon request after your cross‑border payment has been sent.

5) Is MT103 the same as a payment receipt?

Not exactly. A receipt is internal; the MT103 is a standardized SWIFT message with detailed data for tracing.

6) Why do some banks refuse to provide MT103?

Policy differences. Some banks only release MT103s for investigations or specific compliance reasons.

Conclusion

The MT103 Document is central to cross‑border transfers: it confirms payment instructions, supports compliance, and enables tracing. Whether you’re paying suppliers or sending tuition abroad, understanding MT103 helps you communicate with banks and counterparties more effectively. For further reading, see helpful guides from Wise, Flywire, and Money Mover.