If you deal with international finance, you know that standard wire transfers have their limits—mainly time and intermediaries. This is where terms like IPIP, IPID, and StoS come into the conversation.

These aren't just random acronyms; they are the gears and levers that allow funds to move directly between banking servers. While the concepts might seem complex at first glance, they are simply specialized protocols for moving value efficiently. Let’s look at what these terms actually mean and how they function in a professional context.

The Core Trinity: Breaking Down the Acronyms

To understand this, we have to stop thinking about "sending cash" and start thinking about "syncing data."

1. StoS (Server to Server)

The Highway. In corporate banking, this is often called Host-to-Host (H2H) connectivity. Think of it as a dedicated, secure line between two organizations.

- The Tech Spec: Unlike logging into a web portal manually, StoS uses secure protocols (like SFTP or AS2) with heavy encryption.

- The Function: It creates a direct tunnel. There is no human teller involved. The servers "shake hands," authenticate each other, and exchange data packets that represent value. It’s automated and built for volume.

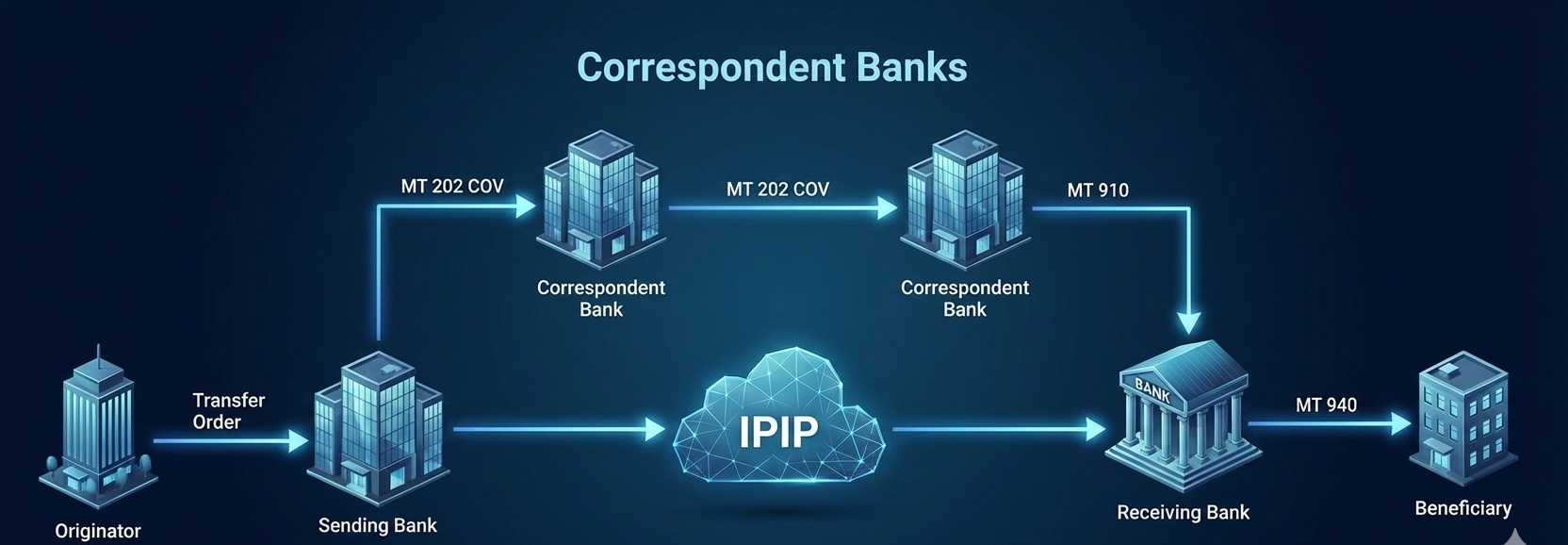

2. IPIP (Internal Payment / Internal Party)

The Upload. IPIP typically refers to a Ledger-to-Ledger transfer.

- How it works: Instead of money traveling from Bank A to Bank B through a Central Bank clearing system, the transaction happens internally within a specific banking network or shared ledger.

- The Advantage: Because the funds technically don't leave the network, the transfer avoids the usual delays of correspondent banking chains. It is effectively an internal reallocation of funds.

3. IPID (International Payment ID)

The Key. If IPIP is the movement, IPID is the address.

- The Distinction: A standard account number (IBAN) tells you where the account is. An IPID in this context is often a unique transactional code generated to identify a specific incoming packet of funds.

- The "Download": The receiver often needs this specific IPID code to "claim" or reflect the funds in their sub-account. It tells the receiving server exactly which transaction belongs to which client, ensuring the funds don't just sit in the bank's general suspense account.

The Technical Reality: How It Differs from SWIFT

It’s important to understand why this is different from the transfers most people are used to.

SWIFT is essentially a messaging system. When you send a wire, Bank A sends a message to Bank B saying "I owe you money." They settle the debt later through correspondent accounts. Result: It can take 24-72 hours.

The StoS/IPIP Method (The Direct Link):

StoS operates on data synchronization:

- Direct Injection: The funds are uploaded to the server (IPIP).

- Instant Reflection: Because the servers are linked (StoS), the receiving system sees the value almost immediately.

- Finality: The receiver uses the IPID to lock the funds into their account.

- Result: Theoretically instant (minutes to hours), provided the connection is stable.

Critical Considerations: Compliance and Safety

While this technology is efficient, it operates in a high-stakes environment.

The "Grey" Market Warning

Because IPIP/StoS transfers often bypass standard public clearing houses, they are less visible to the average banking system. This makes due diligence absolutely critical.

Finality of Payment

In a standard wire, once the message is confirmed, the money is usually on its way. In StoS/IPIP, because it is an internal ledger movement, proper coordination is key. Both the sending and receiving servers must be perfectly synchronized for the transaction to clear successfully.

FAQ

Can I use IPIP for a small personal transfer?

No. The cost and technical requirements to set up a secure Server-to-Server connection are very high. This is generally used for institutional banking, corporate treasury, or specialized private placements.

Is "Downloading" money via IPID illegal?

The technology itself is completely neutral—it is simply a method of database interaction used by banks. However, you should be very careful. Because these terms sound technical and exclusive, they are frequently used by bad actors to make fraudulent schemes look credible. Always exercise extreme caution and ensure you are dealing with verified entities before engaging in these types of transactions.

Does StoS require the same currency?

Generally, yes. To avoid exchange rate complications during an instant transfer, IPIP/StoS is most efficient when moving funds in the same currency (e.g., USD to USD).

What is the "Black Screen" often mentioned with IPIP?

This refers to the command-line interfaces (like Linux or DOS environments) used by back-end bank officers. While customers see a nice web design, the core server instructions are often still executed on these text-based screens for direct access to the ledger.